Oftentimes, these two-insurance coverages are thought to be the same coverage. In reality, each one covers different types of events and they complement each other very well. They are very useful coverages to have in an auto insurance policy. In our beautiful Sunshine State we definitely recommend our customers to have both of them.

Collision Coverage

Under Collision coverage, the insurance company pays for damages if your vehicle overturns or if it collides with another vehicle or object. Collision coverage involves a “deductible” amount you select when you purchase your policy. This deductible, typically $250 or $500, will be deducted from the payment the insurance company will make to repair your damaged vehicle in the event it exceeds the deductible amount.

How does this Collision Coverage works?

Imagine you are involved in a car crash that results in $9,500 worth of repairs to your vehicle (hopefully it will never happen) and you have a $500 deductible. The insurance company will pay $9,000 after subtracting your deductible of $500.

Collision coverage can help you recover for your damages regardless of the other party’s insurance status or even if you were at-fault for the accident. Sadly, some Floridians drive without insurance coverage so having Collision coverage is a good way to protect your vehicle.

Comprehensive Coverage

Under Comprehensive coverage, the insurance company pays for damages caused by an event other than a car collision, such as fire, theft, vandalism, hail, or flood damage. Comprehensive coverage could also cover damages from when you hit an animal while driving. Additionally, if your car is stolen, Comprehensive coverage could cover the cost of a rental vehicle (subject to a daily limit). Like Collision coverage, a deductible usually applies.

It’s important to notice that Comprehensive coverage it’s not the same thing as full coverage.

Statistics

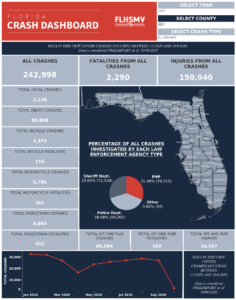

According to the Florida Highway Safety and Motor Vehicle, in 2020, we have so far 242,998 crashes in our State, 2,290 fatalities from all crashes, and 150,940 injuries from all crashes. This year, because of the pandemic, some may say we haven’t been driving as much as other years. Still, those numbers reflect the sad reality that accidents happen and it is good to be as protected as one can be.

Florida

Our Recommendation

We like to encourage our prospects and clients to protect themselves, their assets, and be best prepared with the insurance coverage that is right for them.

We really believe that with life’s uncertainties, and the risk of losing important things, we should protect our hard-earned assets. With Deer Insurance Agency by your side, you can have the peace of mind, confidence, and trust that your insurance needs are well served and protected. Email us at hello@deerinsurance.com for a free quote customized just for you.